Chase Sapphire Preferred® Card review

This perennial travel-rewards card darling offers a lucrative signup bonus with updated rewards-earning categories and access to transfer rewards to popular hotel and flight loyalty programs travelers are sure to enjoy.

Jump to Section

card_name

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- This is a great option for travelers who also enjoy dining out thanks to bonus rewards earned at restaurants.

- CardName cardholders who also hold any other chase card that utilizes the Ultimate Rewards system can combine points in one bucket, meaning your points add up more quickly.

- This card was built was travelers in mind. If travel isn't one of your major spend categories, this card might not be an ideal fit for you.

CardName signup bonus

The CardName is a must-have credit card for any traveler who loves to dine out and reap high-rewards throughout the process.

Currently, new cardholders have an opportunity to claim a nice signup bonus: 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. CardName points are worth 25% more when redeemed through the portal. And, even better, those points could be worth even more if you transfer them to one of Chase’s travel partners. For these reasons (and more – continue on to see why) the CardName is our 2024 CardRatings editor’s top choice for the best travel rewards card.

CardName rewards

In addition to a solid signup bonus, the CardName offers high ongoing rewards rates as well:

- Earn 5x points on travel purchased through Chase Travel

- Earn 3x points when you dine out

- Earn 3x points on select streaming services

- Earn 3x on online grocery store purchases (excluding Target, Walmart and wholesale clubs)

- Earn 2x on all other travel purchases

- Earn 1x on all other purchases worldwide

- Enjoy 25% more value for your points when you redeem for airfare, hotel stays, car rentals and cruises through Chase Travel

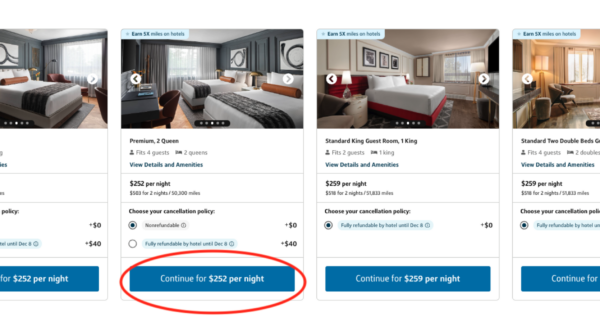

- Receive a $50 Annual Chase Travel Hotel Credit

- Receive an annual points bonus equal to 10% of your total purchases from the previous year

CardName benefits

The CardName has quickly become one of the most popular cards for CardRatings readers. The popularity stems from the ongoing value of this card: high rewards rates, no blackout dates, restrictions or expiration dates on rewards. Cardholders can even use their points to book a flight for someone else.

Cardholders can also take advantage of an additional 25% value for travel when redeeming points through Chase Travel, allowing you to stretch your rewards even further.

Awards tracking and redemption is easy through Chase Ultimate Rewards where you can track your rewards as they accumulate and use your rewards to directly book flights, hotels, cars or cruises.

It is also important to look at the points transfer partners, which include, among others:

- British Airways Executive Club

- World of Hyatt

- Virgin Atlantic Flying Club

- Marriott Bonvoy™

- United MileagePlus®

- IHG® Rewards Club

- Southwest Airlines Rapid Rewards

- Marriott Bonvoy

- JetBlue® TrueBlue

- Flying Blue (numerous airline partners, including Air France and KLM Royal Dutch Airlines)

- For the full list, please see our Chase Ultimate Rewards guide

If you prefer to travel with loyalty programs outside of Chase partners, the CardName may feel limiting to you even though you can use your points to book with any airline – you just can’t transfer points to any airline and take advantage of possibly lower redemption rates.

In addition to easy rewards earning and spending, the CardName offers a number of other useful and money-saving benefits that you should be aware of, including:

- No foreign transaction fees

- Auto rental collision damage waiver

- Trip cancellation/trip interruption insurance

- Zero liability protections

- 24/7 direct access to customer service specialists

- Baggage delay insurance

- And more

How do cardholders rate the CardName?

CardRatings commissioned Slice MR in November 2024 to survey 1,666 cardholders nationwide. Responses were given on a scale of 1-10 and respondents’ ratings were then averaged under broad topics. Here are the results for the CardName:

| Cost Effectiveness | 8.12 |

| Rewards Satisfaction | 8.42 |

| Customer Service | 8.69 |

| Website/App Usability | 8.67 |

| Likehood of Continuing to Use | 8.50 |

| Recommend to a Friend/Colleague | 8.30 |

| Overall Rating | 8.33 |

Survey results by question

Respondents rated their personal experience with the card_name, answering questions on a scale from 1-10. The results for each question can be found below:

How the CardName compares to other travel cards

CardName vs. CardName

discontinued

At AnnualFees the annual fee is a bit steep with the CardName, however, that annual fee gets you a lot.

To start, points are worth 50% more when redeemed for travel through Chase Travel. That means that the signup bonus of 60,000 points once spending $4,000 in the first three months is worth $900 when redeemed through Chase Travel. Additionally, the CardName offers a $300 Annual Travel Credit for reimbursement for travel purchases charged to your card, as well as up to a $120 reimbursement to cover the application fee to Global Entry or TSA PreCheck.

As far as rewards go, the CardName earns a bit more: 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel immediately after the first $300 is spent on travel purchases annually; 3x points on other travel and dining; and 1x point per dollar spent on all other purchases. There’s also a 1:1 point transfer value to leading airline and hotel loyalty programs, and access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass Select.

CardName vs. CardName

discontinued

CardName and CardName both have solid bonus opportunities for new cardholders. New CardName members can earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The CardName offers a bonus of 75,000 miles once you spend $4,000 on purchases within three months from account opening, equal to $750 in travel! The CardName also carries a AnnualFees annual fee.

The big difference between these two cards is that you earn two times the miles on all your purchases every day, plus earn five times the miles on hotels, vacation rentals and rental cars booked through Capital One Travel with the CardName as compared to the tiered points earning with the CardName.

Chase Travel points are transferable to a number of airline and hotel loyalty programs and so are CardName miles, though to different partners than with the Chase card. With the CardName you can fly any airline, stay at any hotel, anytime and not have to worry about blackout dates. Plus, you can transfer your miles to numerous leading travel loyalty programs. Those points might be valuable to you if you have some travel loyalties. Let’s not forget though that Chase bonus points are worth 25% more when you redeem them for travel through Chase Travel.

To learn more about how these two cards line up side-by-side, check out our in depth Chase Sapphire Preferred® vs. Capital One Venture comparison.

Is the CardName worth it?

Though moderate, the CardName does have an annual fee to consider. If you’re only a once-a-year traveler or you rarely dine out, the cost to carry this card might not be worth it to you. However, if you’re a frequent traveler, or at least an occasional traveler who often grabs takeout or enjoys a nice restaurant experience, the CardName can be a fantastic value.

Frequently asked questions

Does Chase Sapphire Preferred® cover Global Entry?

Does Chase Sapphire Preferred® have car rental insurance?

How to downgrade Chase Sapphire Preferred®?

How much are Chase Sapphire Preferred® points worth?

Does Chase Sapphire Preferred® have lounge access?

Does Chase Sapphire Preferred® have foreign transaction fees?

Does Chase Sapphire Preferred® still have hotel credit?

Our Methodology

Survey methodology: CardRatings commissioned Slice MR in November 2024 to survey 1,666 cardholders nationwide. CardRatings’ website analytics from Jan. 1, 2024-Oct. 31, 2024 were used to determine a selection of the most popular cards. Responses to 10 questions were given on a scale of 1-10. For nine of these questions, respondents’ scores were averaged under broad topics. The overall rating represents an average of respondents’ responses to their overall rating of each card.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.