There’s a myth that people with great credit use it sparingly.

In fact, people with excellent credit scores tend to use it more than other people. One example: a recent CardRatings survey found that people with scores of 800 or better generally have more credit card accounts than lower-scoring consumers.

The key to good credit isn’t to skimp on using it, but to use it wisely. The survey’s results provide some insight into how people with exceptional credit get the most out of their credit cards. It also shows how managing your credit card accounts can help your credit score and your finances in general.

People with excellent credit tend to have more credit cards

CardRatings polled over 1,800 consumers about various aspects of their credit card usage. To analyze the results, the responses were broken down into four different tiers according to credit scores. The top tier was people with scores of 800 or better.

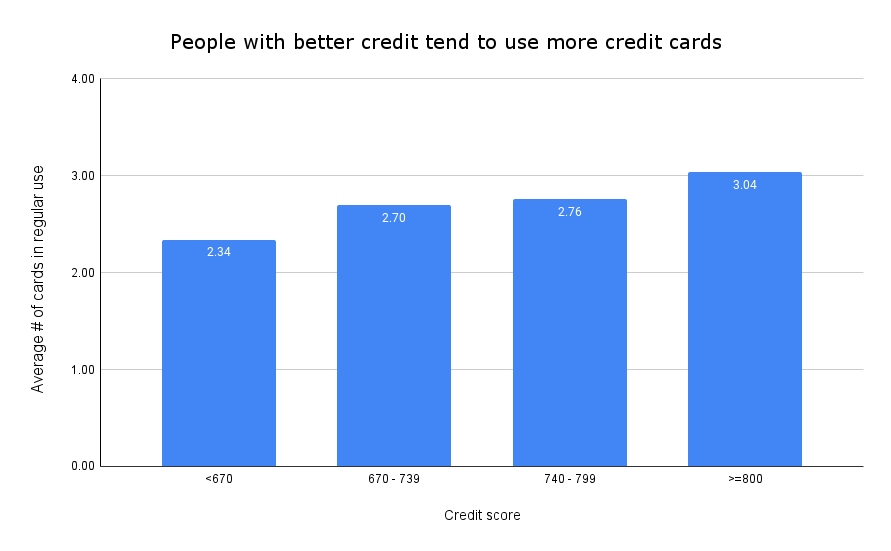

One thing the results showed is that people in the top tier generally had the highest number of credit card accounts. In fact, the number of accounts went up steadily with each credit tier from low to high.

On average, people with credit scores of 800 or better have 3.04 credit card accounts in regular use. In contrast, people in the lowest credit score tier (below 670) have an average of 2.34 credit cards they use regularly. The numbers go up with each successive credit score tier.

Another way to look at this is that in the top credit tier, 30.61% use four or more credit cards on a regular basis. In each of the lower credit tiers, the number of people using four or more cards was under 20%.

Choice gives consumers power

Why does this matter? Well, for one thing it shows that having a great credit score gives you more options.

With strong credit, there is a greater variety of cards you can apply for and get approved. This, in turn, can help you better use credit in a few different ways:

- Finding the most favorable terms. Whether it’s a lower interest rate, no annual fee or more generous rewards, people with excellent credit know that when they see a better credit card deal on the market, they’re likely to get approved for it.

- Matching the card to the situation. If you have multiple cards with different features, you can use them tactically to make the most of each type of situation. If you’re making a purchase you don’t think you’ll pay off right away, you can choose a relatively low-interest credit card. If you’re traveling, you can choose the card with the best travel rewards, and so on.

- Keeping the credit utilization ratio low. Your credit utilization ratio measures the percentage of your credit limit that is currently in use. The amount you owe is the second-biggest factor in determining your credit score, and overall credit utilization ratio is one way this is measured. Having more cards adds to your total credit limit, which makes any given amount of debt a smaller percentage of that limit.

Good credit builds momentum

The benefits of having multiple credit cards is an example of how having good credit tends to feed on itself. A good credit score gives you access to more credit choices. Having more choices helps you use credit more effectively, by minimizing your cost of credit, earning better rewards and keeping your credit utilization ratio down.

In contrast, people with poor credit are often shut out of the best credit card deals, which prevents them from using credit as effectively.

People with excellent credit are happier with their credit cards

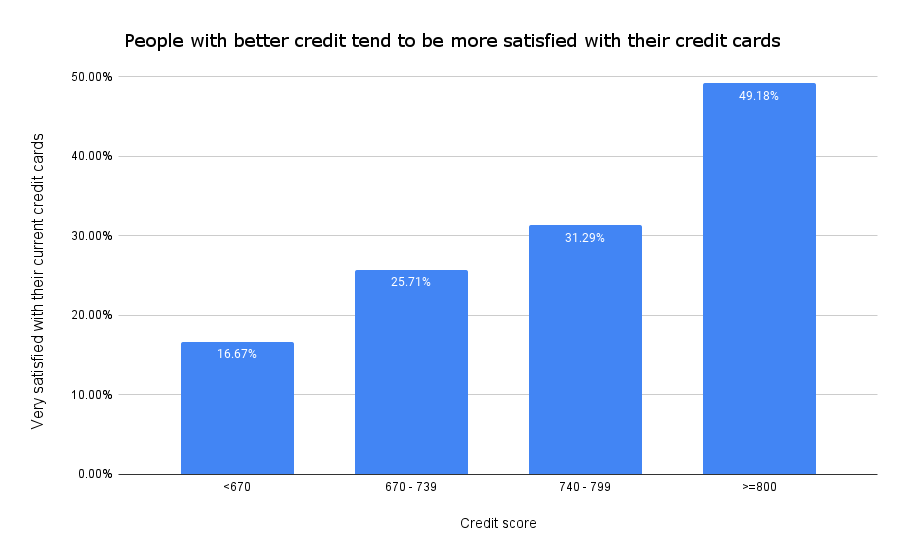

One sign that people with excellent credit scores are making the most of their choices is that they are generally more satisfied with their cards.

Nearly half of survey respondents with credit scores of 800 or better said they were “very satisfied” with their current cards (another 40% described themselves as “satisfied.”) The satisfaction levels for other credit tiers are noticeably lower.

One way being less satisfied manifests itself is in the feeling that there must be a better card out there. Only 37.76% of people surveyed in the top credit score tier feel there is a better card for them on the market than the ones they already have. In contrast, most of the respondents in each of the other three credit score tiers feel they are missing out on the best possible card.

The feeling among people with lower scores that they don’t have the best possible credit card isn’t for lack of trying. In fact, most of the people within the lower three credit score tiers plan to apply for another card within the next year. In contrast, most people in the top tier do not plan to apply for new card within the next year.

Part of what separates these two groups is that people with lower credit scores aren’t always able to get approved for a better deal when they find one, whereas people in the top tier often have already succeeded in securing the best deal.

People with low incomes can succeed with good credit

The advantages that people with excellent credit enjoy may seem to depict a system of “haves” and “have-nots.” However, even people with relatively low incomes have a shot at earning good credit – and the advantages that go along with it.

It is true that generally speaking, the survey confirmed that higher credit scores are generally correlated with higher incomes. Still, exceptions to this rule are common enough that everyone should feel an excellent credit score is worth shooting for. Nearly one in five of the people with credit scores of 800 or better had incomes below $50,000 a year.

This is important, because good credit can help you make the most of a limited budget. A good credit score can give you access to lower interest rates and better reward programs – things that can help you use credit more cost-effectively.

Using multiple credit cards to your advantage

To be clear, simply having a lot of credit card accounts isn’t the key to a good credit score.

In fact, used the wrong way, having a lot of credit cards can just lead to more debt, missed payments and a declining credit score.

So, keep in mind that having multiple accounts will only help your credit score if you use them responsibly:

- Make each payment on time. Having multiple accounts can make your bills harder to keep track of. Make sure you have a system for paying each credit card bill on time.

- Pay your balance off in full whenever possible. While you should at least make the minimum payment on each card, paying your balance off in full whenever possible will help you minimize your cost of using credit and keep your credit utilization ratio low.

- Use your cards tactically. Know the features of each card and decide which one is best for each purchase – a low-interest card if you expect to carry a balance, a card with high rewards for the category of purchase you’re making, etc.

- Apply for new cards opportunistically. Don’t just apply for every new offer you see. Too many applications can actually drag your credit score down. Think about what role a new card would potentially play in your current line-up of credit options. Look for new cards that can do something better or different from your current cards.

Following these tips, and having multiple credit cards can help you build and maintain an excellent credit score.

CardRatings.com commissioned Op4G to conduct a national survey of 1,868 cardholders in September, 2023.