Capital One is a standout among the best credit cards for one major reason: its generous travel benefits. The card_name and the card_name are two of its most popular offerings with a robust rewards structure made to benefit today’s regular traveler.

While they are both attractive in their own right, it is important to know the difference between Capital One Venture and Venture X before you apply. These are two of the best travel rewards credit cards with a competitive APR and generous rewards for cardholders with excellent credit. However, they differ in some key areas – namely, their rewards.

Here, we take a deep dive.

Bonus offers

The Capital One Venture and Venture X cards share the same welcome bonus for new cardholders. Capital One will reward you with 75,000 bonus miles, so you can finally take that long-awaited trip to see the family or get some R&R, once your spend $4,000 on purchases within the first three months of opening an account.

Ongoing rewards

The Capital One Venture and Venture X cards offer the same base reward rate. For every dollar you spend, you earn two miles per dollar. There is no limit to the rewards you receive, either, giving you unlimited earnings based on your spending.

Travel rewards

The main difference between Capital One Venture and Venture X is the travel rewards structure. The Venture X gives you just a bit more, doubling many of your earning opportunities. Both cards offer up to a $120 credit for Global Entry or TSA PreCheck. However, that is where the similarities end.

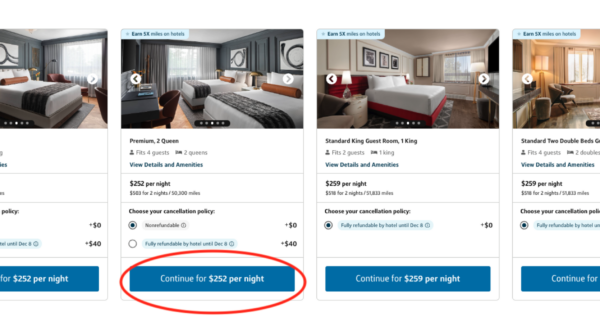

The card_name gives cardholders 5X miles per dollar spent on hotels, vacation rentals, and on rental cars booked through Capital One Travel. There is no limit to the rewards you can receive. You also receive benefits during stays at Lifestyle Collection hotels, such as a $50 experience credit, room upgrades, complimentary Wi-Fi, early check-in, and late checkout.

The card_name doubles some of the reward opportunities. Cardholders receive unlimited 10X miles on hotels and rental cars booked through Capital One Travel, plus unlimited 5X miles on flights and vacation rentals booked through Capital One Travel. You receive benefits for stays at both Lifestyle and Premier Collection hotels, which can include a $100 experience credit, room upgrades, daily breakfast for two, complimentary Wi-Fi, early check-in and late checkout. Venture X cardholders also receive additional travel benefits like a Complimentary Priority Pass membership and complimentary access to 1,300+ airport lounges, including Capital One Lounges and the Capital One Partner Lounge Network.

➤ SEE MORE:Capital One Venture vs. VentureOne

Annual benefits

When comparing the Capital One Venture vs. Venture X cards, another consideration is the annual benefits you receive for each year that you are a cardholder. The Capital One Venture does not offer any annual benefits beyond its normal rewards. However, the Venture X offers bonuses each year including 10,000 anniversary miles and a $300 annual Capital One Travel credit.

Conclusion

There is much to consider when weighing the decision to apply for the Capital One Venture vs. Venture X cards. Each is a popular pick among the best travel credit cards, but they are very different in what they actually offer. The Venture X doubles some of the rewards of the Venture card, but you first must pay an annual fee that is more than triple the cost of the Venture card’s fee.

It all comes down to how much you travel. The Venture is suitable for regular travel, but if you are really the regular jet setter, the Venture X takes things up several notches by doubling rewards and adding complimentary Priority Pass membership with expanded lounge access. It could be well worth it if you are a regular traveler, but the occasional passenger may not find the annual fee worth the investment.

For a side-by-side comparison, here is a look at the primary differences between the Capital One Venture and Venture X cards:

Venture vs. Venture X

Annual Fee

annual_fees

AnnualFees

New Cardholder Bonus Offer

Earn 75,000 miles once you spend $4,000 on purchases within three months from account opening, equal to $750 in travel.

Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening

Rewards

- Unlimited 2X miles per dollar on every purchase

- Unlimited 5X miles per dollar on hotels, vacation rentals and rental cars through Capital One Travel

- Unlimited 2X miles per dollar on every purchase

- Unlimited 5X miles on flights and vacation rentals through Capital One Travel

- Unlimited 10X miles on hotels and rental cars booked through Capital One Travel

- $300 annual Capital One Travel credit

- 10,000 miles anniversary bonus

Redeeming Rewards

- Redeem your miles without blackout dates or brand-loyalty— just make your travel purchases and cover them with a statement credit

- Transfer miles to leading airline and hotel loyalty reward programs – see list of transfer partners

- Redeem your miles without blackout dates or brand-loyalty— just make your travel purchases and cover them with a statement credit

- Transfer miles to leading airline and hotel loyalty reward programs – see list of transfer partners

Foreign Transaction Fees

foreign_transaction_fee

foreign_fee

Travel Benefits

- Up to a $120 credit for Global Entry or TSA PreCheck®

- Lifestyle Collection hotel stay benefits

- $300 credit annually for bookings made through Capital One Travel

- 10,000 mile bonus on each account anniversary

- Up to $120 statement credit for Global Entry or TSA PreCheck®

- Price drop protection

- Access to Capital One Lounge and the Partner Lounge Network

- Hertz President’s Circle status

APR

reg_apr,reg_apr_type

reg_apr,reg_apr_type

For a full synopsis of each card, be sure to check out our card_name and card_name reviews.