With excellent ongoing rewards, valuable new card member welcome offers, and flexible redemption options, the CardName and CardName offer great value with relatively low annual fees. Taking into account the numerous benefits that these cards provide, both of them were named to the CardRatings 2024 list of Best Travel Rewards Credit Cards. While these cards provide a lot of perks on their own, there are some key differentiators that you should take into account when deciding which card is for you. American Express is a CardRatings advertiser.

Annual fees

Like many of their competitors with similar features, both of these cards come with annual fees. While having an annual fee is common for many issuers and cards, both the CardName and the CardName annual fees are noteworthy in their differences. The Sapphire Preferred® has a AnnualFees annual fee compared to the higher AnnualFees annual fee with the American Express Gold card (See Rates and Fees). Both cards do have features and benefits that help to justify or offset the annual fees though. However, if you are evaluating cards based heavily on the fee itself, the Sapphire Preferred® card has the advantage in this area with its lower cost.

Ongoing rewards rates

Another noticeable difference between the CardName and the CardName is their everyday rewards earning rates. While both cards have tiered rewards earning, where purchases in certain categories earn more than purchases in other categories, the rates that the cards earn are different.

With the Sapphire Preferred® card, you have tiered rewards earning with 5X points on all travel booked through Chase Travel℠; 3X Ultimate Rewards points earned per $1 spent on dining purchases (including eligible delivery and takeout); 3X on select streaming services; 3X on online grocery store purchases (excluding Target, Walmart and wholesale clubs); 2X on other travel; and earn 1X point per $1 spent on all other purchases. The Gold from American Express earns 4X points per $1 spent on purchases at restaurants worldwide (on up to $50,000 in purchases per calendar year), then 1X points; 4X points per $1 spent at US supermarkets (on up to $25,000 in purchases per calendar year) then 1X points; 3X points per $1 spent on flights booked directly with airlines or on AmexTravel.com; 2X points per $1 spent on prepaid hotels and other eligible purchases booked on AmexTravel.com; and 1X point per $1 spent on all other eligible purchases.

The Gold card has higher points earning potential in dining out and U.S grocery spend; however, the Sapphire Preferred® has the advantage of the higher earning through Chase Travel bookings and the 2X points (including categories like hotels, car rentals, etc.) instead of just specific airfare spend. Depending on your spending habits, either card could be more valuable for everyday points earning.

Bonus points

The welcome bonus offered to new cardholders is solid with both of these cards. With the CardName, you can earn 60,000 points after you spend $6,000 on eligible purchases on your new card in your first six months of card membership. The CardName, on the other hand, is currently offering new cardholders 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Redemption options

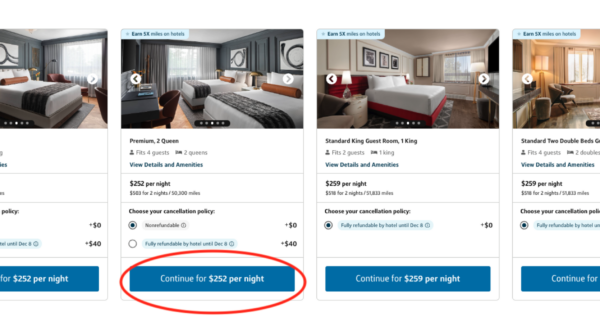

The points earned by the CardName and CardName can be redeemed in a number of different ways. Both the Ultimate Rewards points earned by the Sapphire Preferred® card and the Membership Rewards points earned by the American Express Gold card can be redeemed directly for travel, by transferring points to airline and hotel partners, and redeeming points for purchases on Amazon.com using the Shop with Points feature. One big differentiator for the points redemption between the two cards is the travel partners that you can transfer to. The Membership Rewards program from American Express has over 20 airline and hotel partners including Delta and Hilton Honors while the Ultimate Rewards program from Chase has 13 transfer partners including Hyatt. It’s also worth noting that Sapphire Preferred® points are worth 25% more when redeemed for travel through Chase Travel.

To learn more, check out the table below to compare the various rewards, benefits, features, and fees associated with each card.

Chase Sapphire Preferred® vs. American Express® Gold Card

New Cardholder Bonus Offer

Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Earn 60,000 points after you spend $6,000 on eligible purchases on your new card in your first six months of card membership.

Rewards

Earn 5X points per $1 on travel booked through Chase Travel; 3X points per $1 spent on dining (including eligible takeout and delivery), select streaming services, online grocery store purchases (excluding Target, Walmart and wholesale clubs); 2X points per $1 spent on travel and 1X point per $1 on everything else.

Earn 4X points per $1 spent on purchases at restaurants worldwide (on up to $50,000 in purchases per calendar year), then 1X points; 4X points per $1 spent at US supermarkets (on up to $25,000 in purchases per calendar year) then 1X points; 3X points per $1 spent on flights booked directly with airlines or on AmexTravel.com; 2X points per $1 spent on prepaid hotels and other eligible purchases booked on AmexTravel.com; and 1X point per $1 spent on all other eligible purchases.

Redeeming Rewards

Ultimate Rewards can be redeemed directly for travel, transferred to airline and hotel partners, and redeemed for purchases on Amazon.com using the Shop with Points feature

Points are worth 25% more when redeemed for travel through Chase Travel

Chase Sapphire Preferred® travel partners include:

- British Airways Executive Club

- World of Hyatt

- Virgin Atlantic Flying Club

- Marriott Bonvoy™

- United MileagePlus®

- Southwest Airlines Rapid Rewards

- For the full list, please see our Chase Ultimate Rewards guide

Membership Rewards can be redeemed directly for travel, transferred to airline and hotel partners, and redeemed for purchases on Amazon.com using the Shop with Points feature

American Express Gold Card travel partners include:

- Air France KLM

- Asia Miles

- British Airways Executive Club

- Hilton Honors

- Marriott Bonvoy

- For the full list, please see our guide to American Express Membership Rewards

Travel Benefits

- $50 annual hotel credit for stays booked through Chase Travel

- Lost luggage reimbursement up to $3,000 per passenger

- Travel accident insurance up to $500,000

- Travel and emergency assistance services

- Auto rental collision damage coverage which provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad

- Earn 5X points on Lyft rides through March 2022; That’s 3X points in addition to the 2X points you already earn on travel

- Trip cancellation/interruption insurance up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses

- Trip delay reimbursement up to $500 per ticket if you’re delayed more than 12 hours or require an overnight stay

- Baggage delay insurance up to $100 a day for five days for baggage delays over 6 hours

- $120 dining credit— earn up to a total of $10 in statement credits monthly when you pay with your card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys; enrollment required

- $120 Uber Cash— Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year. Effective 11/8/2024, an Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit.

- Hotel Credit up to $100— receive a $100 credit towards eligible charges with every booking of two nights or more through AmexTravel.com. Eligible charges vary by property.

- Car rental loss and damage insurance

- Access to Global Assist Hotline which provides coordination and assistance services such as lost passport replacement assistance, translation services, missing luggage assistance, and emergency legal and medical referrals when traveling more than 100 miles from home

- Baggage insurance plan up to $1,250 for carry-on baggage and up to $500 for checked baggage

- Enrollment required for select benefits

Purchase Protection

- Zero Liability Protection which means you won’t be held responsible for unauthorized charges made with your card or account information

- Purchase protection covers new purchases made with your card for 120 days against damage or theft up to $500 per claim and $50,000 per account

- Extended warranty protection extends the time period of the U.S. manufacturer’s warranty on items purchases with your card by an additional year on eligible warranties of three years or less

- Dispute resolution— if there is a fraudulent or incorrect charge on your statement, American Express will work with you to resolve the issue

For a full synopsis of each card, be sure to check out our CardName and CardName reviews.

See Rates and Fees for the CardName