Summer is in full swing and Americans are putting their long-awaited travel plans into action. They’re hitting the road, taking to the skies and setting sail to get away from it all.

Part of your travel plan should include figuring out how you’re going to pay for your vacation. Making the right choices can help you avoid coming back to months of unmanageable credit card bills. Planning those choices should start before you leave home.

Avoid mismatches between your purchases and length of debt

As you plan your vacation, figure out what you’re going to spend and how you’re going to pay for it. If you plan to borrow money for your vacation, you should first figure out how long it’s going to take to repay that debt.

One of the ways people accumulate debt is by borrowing money that takes longer to repay than the useful life of what they’re buying. Vacations are a perfect example of this type of mismatch between purchases and the length of debt. After all, vacations typically last just a week or two. People often take much longer than that to pay off what they’ve borrowed to pay for them.

Use a credit card payoff calculator to figure out how long it will take to pay off the amount you’re planning to borrow for your trip. A red flag would be if you expect you’ll want another vacation before you pay off your debt from this vacation. That would mean your debt would end up restricting your ability to pay for your next vacation. Or, you’d be accumulating vacation debt faster than you can pay it off.

With high credit card rates, time really is money

Limiting the length of your debt is always a good idea, but it’s especially important now.

Credit card interest rates have jumped by 6.72% over the past three years. According to Federal Reserve data, the average rate charged on a credit card is now close to its all-time high.

If you have mediocre or poor credit, you can expect to pay an especially high rate. Credit card companies charge consumers with lower credit scores much higher rates than those with excellent credit. A recent CardRatings study found that this difference averages 6.79%, and is often much higher.

High interest rates mean that taking longer to repay your vacation debt can add a lot to the cost of that vacation. Until you figure out how long it’s going to take to repay that debt, you won’t really know how much your vacation is going to cost.

Use credit card rewards to cut down on travel costs

If you use a credit card to pay for a vacation, credit card rewards can help you reduce the cost of that debt.

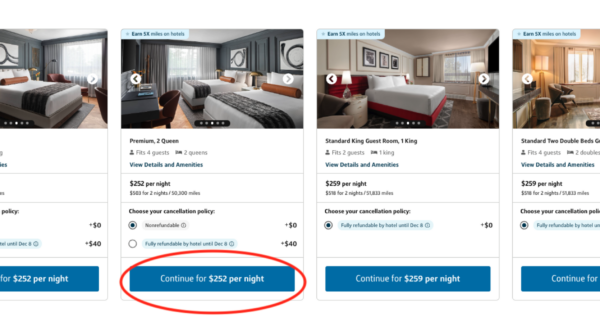

Some credit card rewards can be redeemed for airfare or hotel credits. Otherwise, try to redeem rewards for statement credits to pay off your debt faster.

As you make your travel plans, decide on which credit cards to use based on which offer the most generous rewards for travel-related expenses. Using rewards to cut those expenses can help save you from today’s high-interest charges.

➤ SEE MORE:Best travel credit cards

Credit card sign-up bonuses can also help you reduce vacation debt

Planning a vacation is a good time to shop around for a new credit card. A card with good travel benefits can help you save on the cost of that vacation, and finding a lower interest rate can reduce the cost of any debt you take on.

In addition, some cards offer welcome bonuses to new customers. These may take the form of cash bonuses or extra reward points awarded upon sign-up. Check out these offers to see if they can cut some of the cost off the top of your vacation bills.

One caveat about these offers is that they often come from cards that have high annual fees. Look for a no-fee card, or at least one whose welcome bonus is still worthwhile after you take into account the fee. Also, keep in mind that no credit card bonus is worth taking on debt, just for the sake of earning rewards. This route only makes sense if applying for a new credit card, or putting expenses on a card, aligns with healthy spending and payment habits.

Use a card with travel insurance

If you’re shopping for a new credit card in advance of your vacation, consider one that offers some type of travel insurance. There are travel credit cards that offer insurance for potential mishaps that can happen on a trip, such as:

- Trip cancellation

- Travel delays

- Baggage loss or delays

- Rental car damage

Consider the benefits of these features alongside other credit card terms such as fees, rewards and interest rates. You may find that a card with travel insurance is the right choice for at least some of your vacation expenses.

After all, travel insurance can do more than save you money if something goes wrong on your trip. It can also give you peace of mind even if all goes well.

Plan for repayment as carefully as you plan your vacation

People put a lot of thought into planning a vacation. After all, it’s an important use of your time and money, and a special trip can create a lifetime of memories. People research destinations, hotels and airlines to get the details just right.

To make sure that the memories of your vacation aren’t spoiled by burdensome debts from your trip, put the same amount of time and energy into planning how to finance your trip. Consider the following details:

- Budget for monthly payments that will allow you to pay off your trip as quickly as possible.

- Use a credit card calculator to figure out the total interest cost you’ll pay by the time the debt is paid off.

- Figure out which credit card will pay off the trip most cost-effectively, when interest rates, fees and rewards are taken into account.

Making the most efficient choices about financing will help your vacation leave you with great memories instead of troublesome debt.