If you’re like many people, you’re eager to hit the open road, relax in resorts, or explore the world. Leaving home base is exciting, especially after years of Covid-related restrictions. It can also be expensive, however, and airports may be crowded and unpleasant. Because of this, a travel credit card can be your most valued tool. But while there are many pros to having one, there are also some cons to consider. Take the time to understand what they are before applying. When you do, you can be certain that you are equipped with the best travel card for you, should you need one.

Pros of travel credit cards

First the good. There are plenty of reasons why a travel credit card is an excellent addition to your wallet. Depending on the card you get, it might offer:

Generous welcome bonus. Many travel cards offer welcome bonuses that you can walk away with after spending a certain amount on your new card within a specific timeframe. Usually the bonus comes in the form of miles or points, which can sometimes add up to enough for multiple domestic round-trip flights or possibly even an international flight. That alone can save you a tremendous amount of money when you’re planning a trip. See the best credit card welcome bonuses.

Ongoing rewards. Almost all travel cards are rewards based, meaning they have a program that has been designed with the traveler in mind. That means you will earn the most rewards when you book such expenses as flights and hotel rooms or book rental cars. If you believe you will be out and about quite a lot and will use your card to pay, those miles and points can rack up fast.

Airport lounges. There’s nothing like the ability to duck into a refined space at the airport where you will be treated to free snacks, drinks, and a quiet place to put your feet up. Some credit cards offer Priority Pass, and with it you can go to over a thousand of such lounges throughout the world’s airports, while others give you a couple of passes at your annual anniversary. See the best credit cards with airport lounge access.

Priority boarding. Want to get on the plane before others so you can stash your overhead luggage without fear that it will have to be checked because a lack of space? Whatever your reason for wanting to be among those who are first on board, travel credit cards sometimes have the perk of allowing you to move to the front of the line.

Complimentary checked bags. If you do want to check your bags, in many cases it will cost you $35 or more. However, a typical benefit for a travel card that is associated with an airline is that you can have at least one free checked piece of luggage, and sometimes even additional items checked free for members of your party. This perk can really help you come out ahead financially if you book a basic airfare, because those seats usually disallow even carryon luggage. With this reward, you can check your bag without an additional fee and still score the cheapest airfare possible.

Travel insurance. Most travel cards include several types of insurance products. For example, you may have protection against lost or damaged luggage. Your card may also come with insurance for trip cancellation and car rental protection.

➤ SEE MORE: Guide to travel credit card insurance

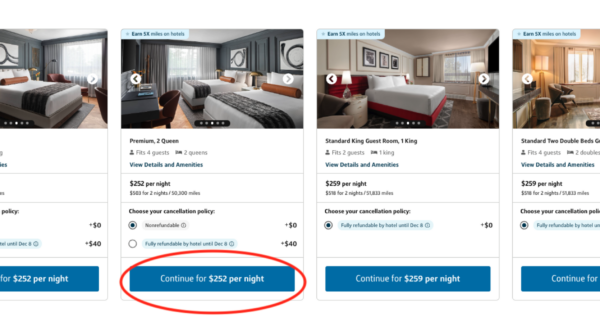

Premium hotel status. Some credit cards have partnered with hotel chains. In that case you may have premium status enabling you to check in early, check out late, enjoy upgraded rooms for the same price as a standard room, and maybe even free accommodations gifted at your account anniversary.

Credits galore. Who doesn’t want to eat or drink for free? With the right travel credit card, you may be entitled to hundreds of dollars worth of annual statement credits that you can use for food and drink at the hotel or airline you book with your credit card. Or you may have credits to use for Global Entry/TSA PreCheck®, and car share services such as Lyft and Uber.

Travel portal and concierge services. To make your vacation plans a seamless process, you may want to turn to your travel credit card company. With their travel portal, you can book many of your arrangements, from flights to hotels, using your credit card for cash or redeeming your rewards. And when you need a little extra help, you may be able to turn to the company’s concierge, who can assist you with booking special restaurants or events.

Cons of travel credit cards

While there aren’t as many downsides to travel credit cards as there are upsides, there are still a few to be aware of before you decide to apply. Among them:

High credit requirements. The majority of travel credit cards, especially those that come with the most valuable rewards, also tend to require high credit scores. Therefore if you haven’t established your credit yet or have had some problems in the past, these cards may not be available to you until you drive those scores up.

Potentially expensive annual fee. All those rewards and perks don’t come for free. While some travel credit cards do not have an annual fee, others can cost hundreds of dollars. If you do not use enough of the perks to make the account worth your while, that fee could end up costing you more than the benefits are worth.

Low rewards for non-travel expenses. It should go without saying that travel cards are designed for people who will do just that – travel. The rewards you earn will be elevated when you use the card to purchase travel related expenses. That means they’re not very good for people who will be sticking close to home and regularly using a credit card for other goods and services.

Potential restrictions on reward redemptions.. While you can pay for your trip with the rewards you’ve earned, when you want to redeem them, you may experience some barriers. Airlines and hotels may impose blackout dates for when you can use your points or miles, or may have limited inventory for reward redemption.

What is the best travel rewards credit card?

CardName has long been a CardRatings favorite for travel rewards. This card offers a huge welcome bonus opportunity to new cardholders, and on an ongoing basis, earns bonus rewards on travel and restaurant purchases and more. Chase Ultimate Rewards® points are consistently recognized as one of the most valuable point currencies on the market thanks to their flexibility, and with this card, points are worth 25% more when redeemed through Chase Travel℠. Points can also be transferred directly to a number of airline and hotel loyalty programs, so this card truly is hard to beat when it comes to planning a vacation.

Furthermore, if you have another Chase Travel earning card, such as CardName or CardName, you can pool all of your points under your Chase Sapphire Preferred® account, making them worth 25% more towards travel. The no-annual-fee CardName earns 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate, and the no-annual-fee Chase Freedom Unlimited® earns unlimited 1.5% cash back on all non-bonus purchases. Pairing these cards with the Chase Sapphire Preferred® card is a great rewards strategy and can help you rack up a ton of points for your next vacation with ease. (Information related to Chase Freedom FlexSM has been collected independently by CardRatings and was neither reviewed nor provided by the card issuer)

When it comes down to it though, all of our travel needs are unique, so the best card for one traveler might not be the best option for the next. The Chase Sapphire Preferred® card is great for travelers craving flexibility, but flexibility might not be an important trait for everyone. If you’re loyal to a particular airline, for instance, you’ll likely fare better with a branded airline card thanks to perks like free checked bags, lounge passes, and priority boarding. Or if you stay at the same hotel every time you travel, free night stays or room upgrades may mean more to you. Choosing the best credit card for travel rewards really just depends on how you travel, and how you spend your money.

Compare Top Travel Credit Cards

Compare

Get the right travel card for your lifestyle

It is important to read the benefits and requirements of each card to determine if it fits your credit profile and lifestyle. You may want to splurge for a travel card that has a high annual fee and more extreme rewards, or scale back and get one with no or a low annual fee but that doesn’t have so many bells and whistles. And of course, if you don’t plan on traveling in the future, there are plenty of other cards from which to choose. You can check out our list of best credit cards for more.